Covid Relief Package for MSME Sector:

Covid Relief Package for MSME Sector: Rs 3 lakh crores Collateral-free Automatic Loans for Businesses, including MSMEs:

- Businesses/MSMEs have been badly hit due to COVID19 need additional funding to meet operational liabilities built up, buy raw material and restart business

- Decision: Emergency Credit Line to Businesses/MSMEs from Banks and NBFCs up to 20% of entire outstanding credit as on 29.2.2020

- Borrowers with up to 25 crore outstanding and Rs. 100 crore turnover eligible.

- Loans to have 4 year tenor with moratorium of 12 months on Principal repayment.

- Interest to be capped.

- 100% credit guarantee cover to Banks and NBFCs on principal and interest.

- Scheme can be availed till 31st Oct 2020.

- No guarantee fee, no fresh collateral.

- 45 lakh units can resume business activity and safeguard.

Rs 20,000 crores Subordinate Debt for Stressed MSMEs:

- Covid Relief Package for MSME SectorStressed MSMEs need equity support.

- Covid Relief Package for MSME Sector GoI will facilitate provision of 20,000 cr as subordinate debt.

- Two lakh MSMEs are likely to benefit.

- Functioning MSMEs which are NPA or are stressed will be eligible.

- Covid Relief Package for MSME Sector- provide a support of Rs. 4,000 Cr. to CGTMSE.

- CGTMSE will provide partial Credit Guarantee support to Banks.

- Promoters of the MSME will be given debt by banks, which will then be infused by promoter as equity in the Units.

Rs 50,000 cr. Equity infusion for MSMEs through Fund of Funds

- MSMEs face severe shortage of Equity.

- Covid Relief Package for MSME Sector- Fund of Funds with Corpus of Rs 10,000 crores will be set up.

- Will provide equity funding for MSMEs with growth potential and viability.

- FoF will be operated through a Mother Fund and few daughter funds.

- Fund structure will help leverage Rs 50,000 cr of funds at daughter funds level.

- Will help to expand MSME size as well as capacity.

- Will encourage MSMEs to get listed on main board of Stock Exchanges.

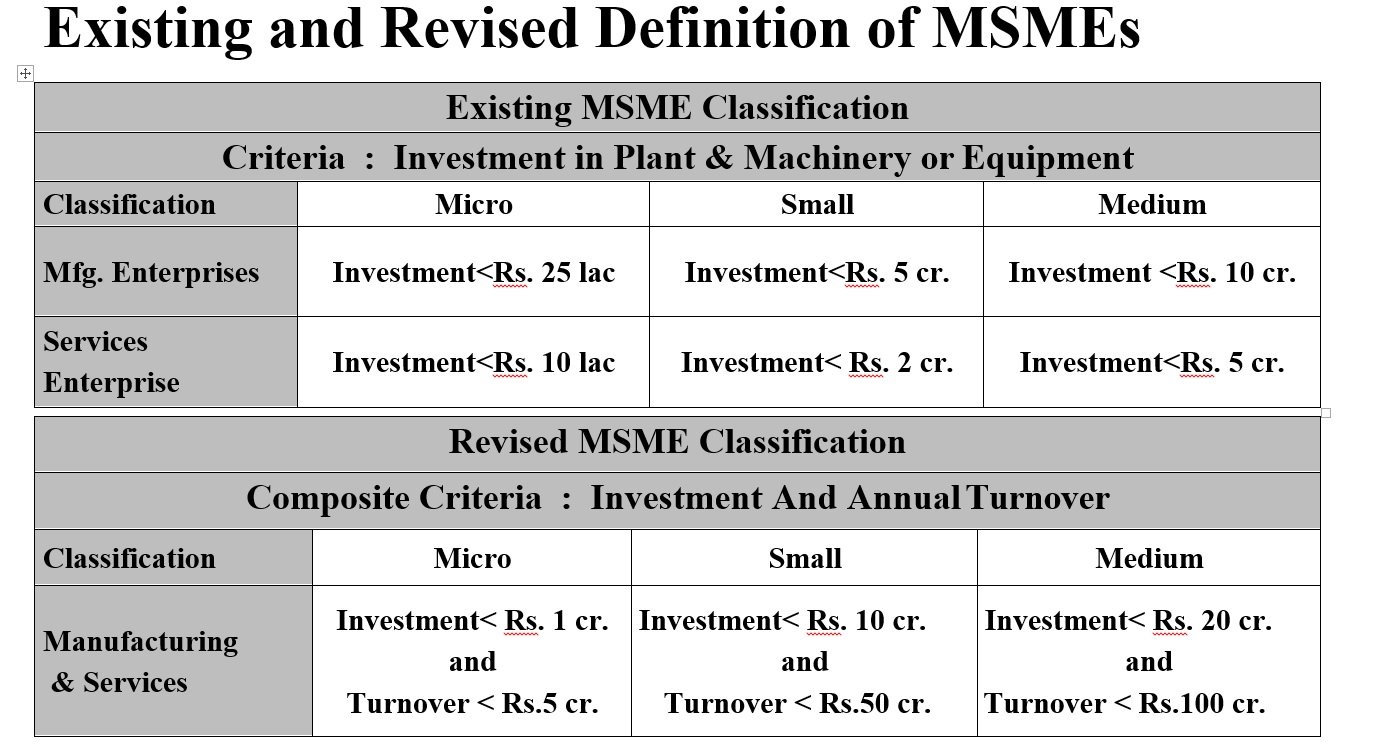

New Definition of MSMEs

- Low threshold in MSME definition have created a fear among MSMEs of graduating out of the benefits and hence killing the urge to grow.

- There has been a long-pending demand for revision.

- Definition of MSMEs will be revised

- Investment limit will be revised upwards

- Covid Relief Package for MSME Sector-Additional criteria of turnover also being introduced.

- Distinction between manufacturing and service sector to be eliminated.

- Necessary amendments to law will be brought about,

Existing and Revised Definition of MSMEs:

Global tenders to be disallowed upto Rs 200 crores:

- Indian MSMEs and other companies have often faced unfair competition from foreign companies.

- Covid Relief Package for MSME Sector- Therefore, Global tenders will be disallowed in Government procurement tenders upto Rs 200 crores

- Necessary amendments of General Financial Rules will be effected.

Other interventions for MSMEs:

- MSMEs currently face problems of marketing and liquidity due to COVID.

- Covid Relief Package for MSME Sector- e-market linkage for MSMEs to be promoted to act as a replacement for trade fairs.

- Fintech will be used to enhance transaction based lending using the data generated by the e-marketplace.

- Government has been continuously monitoring settlement of dues to MSME vendors from Government and Central Public Sector Undertakings.

- MSME receivables from Gov and CPSEs to be released in 45 days

Rs. 2500 crore EPF Support for Business & Workers for 3 more months

- Businesses continue to face financial stress as they get back to work.

- Under Pradhan Mantri Garib Kalyan Package (PMGKP), payment of 12% of employer and 12% employee contributions was made into EPF accounts of eligible establishments.

- This was provided earlier for salary months of March, April and May 2020. This support will be extended by another 3 months to salary months of June, July and August 2020.

- This will provide liquidity relief of Rs 2500 cr to 3.67 lakh establishments and for 72.22 lakh employees.

EPF contribution reduced for Business & Workers for 3 months- Rs 6750 crores Liquidity Support

- Businesses need support to ramp up production over the next quarter.

- It is necessary to provide more take home salary to employees and also to give relief to employers in payment of Provident Fund dues,

- Therefore, statutory PF contribution of both employer and employee will be reduced to 10% each from existing 12% each for all establishments covered by EPFO for next 3 months.

- CPSEs and State PSUs will however continue to contribute 12% as employer contribution.

- This scheme will be applicable for workers who are not eligible for 24% EPF support under PM Garib Kalyan Package and its

- This will provide relief to about 6.5 lakh establishments covered under EPFO and about 4.3 crore such employees.

- This will provide liquidity of Rs 6750 Crore to employers and employees over 3 months.

Rs 30,000 crore Special Liquidity Scheme for NBFCs/HFCs/MFIs

- NBFCs/HFCs/MFIs are finding it difficult to raise money in debt markets.

- Government will launch a Rs 30,000 crore Special Liquidity Scheme

- Under this scheme investment will be made in both primary and secondary market transactions in investment grade debt paper of NBFCs/HFCs/MFIs

- Will supplement RBI/Government measures to augment liquidity

- Securities will be fully guaranteed by GoI

- This will provide liquidity support for NBFCs/HFC/MFIs and mutual funds and create confidence in the market.

Rs 45,000 crore Partial Credit Guarantee Scheme 2.0 for NBFCs

- NBFCs, HFCs and MFIs with low credit rating require liquidity to do fresh lending to MSMEs and individuals.

- Existing PCGS scheme to be extended to cover borrowings such as primary issuance of Bonds/ CPs (liability side of balance sheets) of such entities

- First 20% of loss will be borne by the Guarantor ie., Government of India.

- AA paper and below including unrated paper eligible for investment (esp. relevant for many MFIs)

- This scheme will result in liquidity of Rs 45,000 crores.

Rs. 90,000 Cr. Liquidity Injection for DISCOMs

- Revenues of Power Distribution Companies (DISCOMs) have plummeted.

- Unprecedented cash flow problem accentuated by demand reduction

- DISCOM payables to Power Generation and Transmission Companies is currently ~ Rs 94,000 cr

- PFC/REC to infuse liquidity of Rs 90,000 cr to DISCOMs against receivables.

- Loans to be given against State guarantees for exclusive purpose of discharging liabilities of Discoms to Gencos.

- Linkage to specific activities/reforms: Digital payments facility by Discoms for consumers, liquidation of outstanding dues of State Governments, Plan to reduce financial and operational

- Central Public Sector Generation Companies shall give rebate to Discoms which shall be passed on to the final consumers (industries).

Relief to Contractors

• Extension of up to 6 months (without costs to contractor) to be provided by all Central Agencies (like Railways, Ministry of Road Transport & Highways, Central Public Works Dept, etc)

- Covers construction/ works and goods and services contracts

- Covers obligations like completion of work, intermediate milestones and extension of Concession period in PPP contracts

- Government agencies to partially release bank guarantees, to the extent contracts are partially completed, to ease cash flows

Extension of Registration and Completion Date of Real Estate Projects under RERA

- Adverse impact due to COVID and projects stand the risk of defaulting on RERA timelines. Time lines need to be extended.

- Ministry of Housing and Urban Affairs will advise States/UTs and their Regulatory Authorities to the following effect:

- Treat COVID-19 as an event of ‘Force Majeure’ under

- Extend the registration and completion date suo-moto by 6 months for all registered projects expiring on or after 25th March, 2020 without individual

- Regulatory Authorities may extend this for another period of upto 3 months, if needed

- Issue fresh ‘Project Registration Certificates’ automatically with revised timelines.

- Extend timelines for various statuary compliances under RERA concurrently.

- These measures will de-stress real estate developers and ensure completion of projects so that homebuyers are able to get delivery of their booked houses with new timelines.

Rs 50,000 crores liquidity through TDS/TCS rate reduction

- In order to provide more funds at the disposal of the taxpayers, the rates of Tax Deduction at Source (TDS) for non-salaried specified payments made to residents and rates of Tax Collection at Source (TCS) for the specified receipts shall be reduced by 25% of the existing rates.

- Payment for contract, professional fees, interest, rent, dividend, commission, brokerage, etc. shall be eligible for this reduced rate of TDS.

- This reduction shall be applicable for the remaining part of the FY 2020-21 i.e. from tomorrow to 31st March,2021.

- This measure will release Liquidity of Rs. 50,000 Creore.

Other Direct Tax Measures

- All pending refunds to charitable trusts and non- corporate businesses & professions including proprietorship, partnership, LLP and Co-operatives shall be issued.

- Due date of all income-tax return for FY 2019-20 will be extended from 31st July, 2020 & 31st October, 2020 to 30th November, 2020 and Tax audit from 30th September, 2020 to 31st October,2020.

- Date of assessments getting barred on 30th September,2020 extended to 31st December,2020 and those getting barred on 31st March,2021 will be extended to 30th September,2021.

- Period of Vivad se Vishwas Scheme for making payment without additional amount will be extended to 31st December,2020.

SOURCE: PIB, Government of India.