IND AS 109 FINANCIAL INSTRUMENTS:

Accounting Standard dealing with IND AS 109 Financial instruments:

MCA notified following Ind AS to deal with accounting of financial instrument:

- Ind AS 109 – Financial instruments

- Ind AS 32 – Financial instrument: Presentation

- Ind AS 107 – Financial Instrument: Disclosures

In this article we deal with Ind AS 109 ” Financial Instrument” : Classification, Recognition and Measurement aspects of Financial Instrument.

Topics to be dealt with under this article is summarized as under:

- Meaning of Financial instruments

- Classification of financial assets

- Business model test

- Contractual cash flow characteristics’ test

- Classification of financial liabilities

- Reclassification

- Initial measurement

- Subsequent measurement

Financial instruments:

- Any contract that gives rise to both:

- a financial asset of one entity, and

- a financial liability or equity instrument of another entity.

- Points to be Noted:

- Contract refers to an agreement between two or more parties that has clear economic consequences and which parties usually are bound to adhere, usually because the agreement may be enforceable by law.

- Contracts need not be in writing and may take a variety of forms.

- Any assets or liabilities that are not contractual are not financial liabilities or financial assets. For eg. income taxes are a statutory obligation and not arising from contract, constructive obligations as defined in Ind AS 37 – Provisions, Contingent Liabilities and Contingent Assets do not arise from contracts and hence, are not financial liabilities.

Meaning of Financial asset:

An asset that is:

- Cash

- An equity instrument of another entity

- A contractual right:

- To receive cash or another financial asset; or

- To exchange financial assets or financial liabilities under potentially favourable conditions; or

- A contract that will or may be settled in the entity’s own equity instruments and is:

- A non derivative for which the entity is or may be obliged to receive a variable number of the entity’s own equity instruments; or

- A derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity.

Examples of Financial Assets:

► Cash

► Trade receivables

► Investments in bonds and deposits

► Investment in equity instruments

► Loans receivable, etc.

Identify following item is Financial assets or not ?

- Shares of subsidiary companies.

- Advance given for purchase of goods.

- Investment in perpetual debt carrying interest at fixed rate.

- Prepaid expense.

- Deferred tax asset

- CENVAT credit receivable.

- Lease deposit paid

- Shares of the entity held by consolidated ESOP Trust

- Option held by the entity. The entity is buyer of the option

- Gold/Silver bullion.

Answer:

- Yes, However, investment in subsidiary is generally not covered under Ind AS 109.

- No, There is no contractual right to receive cash/other financial assets

- Yes, Instrument contains contractual right to receive interest at stated rate

- No, There is no contractual right to receive cash/other financial assets

- No, Not arising because of contractual arrangement

- No, Not arising because of contractual arrangement

- Yes, The lessee has contractual right to receive lease deposit at the end of lease term

- No, Own equity instruments are not financial asset for the entity

- Yes, Financial instruments include not only primary financial instruments but also derivatives instruments. Since the entity is option buyer, it is potentially favourable to the entity.

- No, Commodity. Although gold bullion is highly liquid, there is no contractual right to receive cash or another financial asset.

Meaning of Financial liability:

Any liability that is :

► a contractual obligation:

- to deliver cash or another financial asset to another entity;

- to exchange financial assets/ liabilities under potentially unfavourable conditions; or

► a contract that will or may be settled in the entity’s own equity instruments and is:

- a non derivative for which the entity is or may be obliged to receive a variable number of the entity’s own equity instruments; or

- a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments.

Identify the financial liabilities :

- Tax liability

- Finance lease obligations

- Non-refundable revenue received in advance

- Non-refundable advance received against sale of government securities

- Liability for damages under a lawsuit

- Financial guarantees given

Answer :

- No. Tax liability arises as per the requirements of law and not because of contractual arrangement

- Yes. However, accounting for financial lease obligations, except derecognition, is not covered under Ind AS 109. It is covered under Ind AS 17.

- No. There is no contractual obligation to pay cash/other financial assets

- Yes. Instrument contains contractual obligation to deliver other financial asset, viz., government securities

- No. Not arising because of contractual arrangement

- Yes. The entity has contractual right to pay cash if the original debtor fails to pay. For an instrument to be classified as financial liability, it is not necessary that the entity should have an unconditional obligation to pay. Contractual obligation to pay which are contingent upon future events are also financial liability.

Meaning of Equity instruments:

► Any contract that evidences a residual interest in the net assets of an entity.

Examples:

► Equity shares.

► Preference shares (if certain criteria are met)

► Warrants

► Written call options to issue fixed number of equity shares for a fixed price.

Principles of liability/equity classification:

A financial instrument or its component parts should be classified by the issuer upon initial recognition as a financial liability or an equity instrument according to the substance of the contractual arrangement, rather than its legal form, and the definitions of a financial liability and an equity instrument. For some financial instruments, although their legal form may be equity, the substance of the arrangements is that they are liabilities. A preference share, for example, may display either equity or liability characteristics depending on the substance of the rights attaching to it.

The appropriate classification as a financial liability, equity or a combination of both, is determined by the entity when the financial instrument is initially recognised and that classification is not generally changed subsequently unless the terms of the instrument change. As exceptions to this general principle, there are certain circumstances in which reclassification may be appropriate even though the terms of the instrument have not changed. Reclassification will be discussed later in brief.

When classifying a financial instrument in the consolidated financial statements, an entity should consider all of the terms and conditions agreed upon between members of the group and the holders of the instrument. For example, a financial instrument issued by a subsidiary could be classified as equity in the subsidiary’s individual financial statements and as a liability in the consolidated financial statements if another group entity has provided a guarantee to make payments to the holder of the instrument.

The key feature in determining whether a financial instrument is a liability is the existence of a contractual obligation of one party (the issuer) to deliver cash or another financial asset to another party (the holder), or to exchange financial assets or liabilities under conditions that are potentially unfavourable. In contrast, in the case of an equity instrument (e.g. ordinary shares) the right to receive cash in the form of dividends or other distributions is at the issuer’s discretion and, therefore, there is no obligation to deliver cash or another financial asset to the holder of the instrument.

Compound instruments:

The terms of a financial instrument may be structured such that it contains both equity and liability components (i.e. the instrument is neither entirely a liability nor entirely an equity instrument). Such instruments are defined as compound instruments. An example of a compound instrument is a bond that is convertible, either mandatorily or at the option of the holder, into a fixed number of equity shares of the issuer. Compound instruments come in many forms and are not restricted solely to convertible instruments. The liability and equity components of a compound instrument are required to be accounted for separately.

The requirement to separate out the equity and financial liability components of a compound instrument is consistent with the principle that a financial instrument must be classified in accordance with its substance, rather than its legal form. A compound instrument takes the legal form of a single instrument, while the substance is that both a liability and an equity instrument exist.

For example, a convertible bond that pays fixed coupons and is convertible by the holder into a fixed number of ordinary shares of the issuer has the legal form of a debt contract; however, its substance is that of two instruments:

- a financial liability to deliver cash (by making scheduled payments of coupon and principal) which exists as long as the bond is not converted; and

- a written call option granting the holder the right to convert the bond into a fixed number of ordinary shares of the entity.

Separating the liability and equity components:

Separation of the instrument into its liability and equity components is made upon initial recognition of the instrument and is not subsequently revised. The method used is as follows:

- firstly, the fair value of the liability component is calculated, and this fair value establishes the initial carrying amount of the liability component; and

- secondly, the fair value of the liability component is deducted from the fair value of the instrument as a whole, with the resulting residual amount being recognised as the equity

The fair value of the liability component on initial recognition is the present value of the contractual stream of future cash flows (including both coupon payments and redemption amount) discounted at the market rate of interest that would have been applied to an instrument of comparable credit quality with substantially the same cash flows, on the same terms, but without the conversion option.

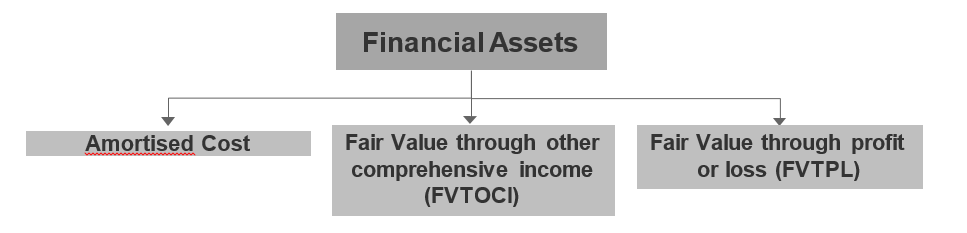

Classification of financial assets:

Financial assets has been classified into three categories as per Ind AS 109:

Financial assets shall be classified on the basis of both:

- the entity’s business model for managing the financial assets and

- the contractual cash flow characteristics of the financial assets.

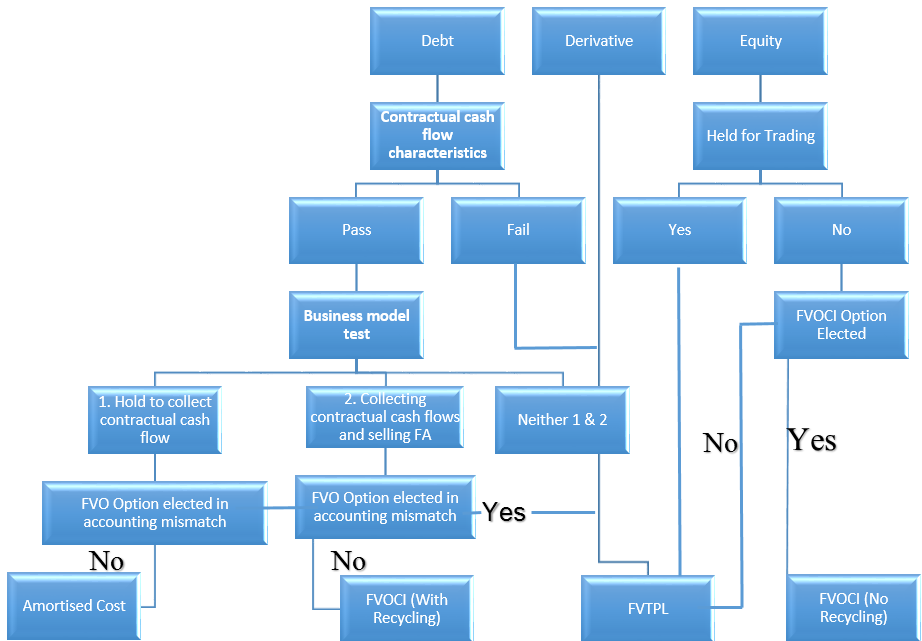

Classification and measurement model of financial assets:

If Business Model of the investment is just to do trading activities then it should be classified and measured through FVTPL. if Business Model is get the contractual cash flows i.e. solely in the nature of principal and interest and Hold to collect the contractual cash flows then it should be classified as Amortised Cost. If Business Model is collecting contractual cash flows and selling Financial Assets then it should be classified as FVOCI. If there is some accounting mismatch for eg. In the Insurance Company, Main Expenditure is settlement of Claims and Main source of Income is Premium collect. The investment done by the insurance company from the receipts from premium and if it is classified through FVOCI, the changes in the investment is goes to Equity, then it will be accounting mismatch because of Expenditure is going to Income statement and Income from investment is going to Equity, in this situation there is scope in Ind AS 109 to allow the investment to classified as FVTPL even it is satisfied the Business Model test and Contactual Cash Flow test. Therefore it is demonstrate there is accounting mismatch, then investment can be opt to classified as FVTPL. No Recycling means that if changes in fair value of investment in equity shares parked in Other Comprehensive Income and at the time of disposal of investment, it will not be recycle back to the income statement and in this case of FVOCI option in the Equity shares is irrevocable option.

Contractual cash flow characteristics’ test:

- Contractual terms of the financial asset give rise, on specified dates, to cash flows that solely represent principal and interest payments.

- ‘Interest’ is consideration for the time value of money and the credit risk associated with the principal amount outstanding during a particular period of time.

- Contractual cash flow characteristic that introduces leverage do not have the characteristics of interest e.g. option, forward and swap contracts.

In the case of investment in the Convertible Debenture, Rates of interest is lower side as compare to normal debenture without conversion rights, hence the rate of interest of convertible debenture not reflect the market rate of interest i.e. leverage. Therefore, the holder of Convertible Debenture, it will give rise to leverage hence this investment not satisfied the business model test and contractual cash flow test, it will be classified as FVTPL.

Classification of financial liabilities:

Financial liabilities has been classified into two categories:

1. Fair value through profit or loss:

► Financial liabilities that are held for trading (including derivatives).

► Financial liabilities that are designated as FVTPL on initial recognition.

► Contingent consideration recognised by an acquirer in a business combination.

2. Amortised Cost:

► All liabilities not in the above category.

Reclassification:

Financial Assets:

► When and only when entity changes its business model for managing financial assets, reclassification of financial assets is required. Such changes expected to be very rare.

► If financial asset is reclassified from amortised cost to FVTPL, its fair value is determined at reclassification date and gains or losses recognised in profit or loss.

► If financial asset reclassified from FVTPL to amortised cost, its fair value at reclassification date becomes new carrying amount.

Financial Liabilities:

► Reclassification of financial liabilities is not allowed.

Initial Measurement:

“The fair value of a financial instrument on initial recognition is normally the transaction price.”

Example : Interest free lease deposit:

Company A leases a tower site from Company B. A gives a lease deposit of INR 100,000 to Company B for five years and classifies the resulting asset within loans and receivables. The deposit carries no interest.

On initial recognition, the market rate of interest for a five year loan with payment of interest at maturity is 10% per year.

How will the deposit be recorded in the financial statements of entity A?

Answer:

The initial fair value of the deposit is the present value of the future payment of INR 100,000, discounted using the market rate of interest for a similar loan of 10% for five years. This equates to INR 621,000.

Rationally, A would also expect to obtain other future economic benefits that have a fair value of INR 379,000 (the difference between the total consideration given of INR 100,000 and the loan’s initial fair value of INR 621,000). The difference is not a financial asset, since it is paid to obtain expected future economic benefits, which here relate to the underlying lease. A recognises that amount as a prepayment on the lease and amortises the resulting asset on a straightline basis over the period of the lease.

Accounting Entries:

For Securities Deposit 100 Discounted value 70 Period 5 Year:

1. Security Deposit Dr 100

To Bank Cr 100

2. Prepaid Rent Dr 30

To Security Deposit Cr 30

Unwinding:

Notional Expenditure will be booked:

3. Rent Dr 5

To Prepaid Rent Cr 5

Notional Income will be booked:

4. Securities Deposit Dr 5

To Interest Income Cr 5

Note: If security deposit payable on demand or any occurrence of event then it will not be discounted.

Subsequent measurement:

Financial assets:

| Financial assets | Measurement | Recognition of fair value changes |

| FVTPL | Fair value | Profit or loss |

| FVTOCI | Fair value | · OCI except for dividends/interest

· Dividends in income statement · Interest in income statement through EIR · No recycling from OCI to P&L (except for debt instruments classified as FVOCI) |

| Amortised cost | Amortised cost | Not relevant |

Financial Liability:

| Financial Liabilities | Measurement | Recognition of fair value changes |

| FVTPL | Fair value | · FV change attributable to own credit risk in OCI except if this creates or enlarges an accounting mismatch.

· Remainder in profit or loss. |

| Amortised cost | Amortised cost | Not relevant |