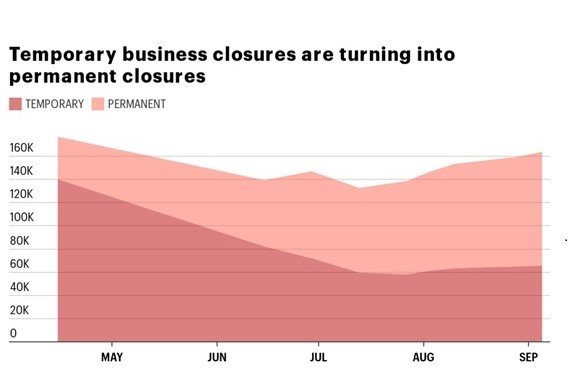

The pandemic has had a devastating impact on the financial stability of businesses worldwide, especially small enterprises. According to a survey, approximately 92% of small business owners reported significant financial hardships directly caused by the pandemic. As a consequence, many of these businesses have been left with no other option but to shut down permanently.

To elaborate further, the pandemic’s widespread effects on public health and safety measures, such as lockdowns and restrictions, have led to a sharp decline in economic activity. Small businesses, which often operate with limited resources and reserves, were particularly vulnerable to these sudden disruptions. Reduced customer footfall, supply chain disruptions, and increased operational costs further compounded their financial struggles.

When facing financial constraints, it is still possible to revitalize your company and set it on a path towards growth. Here are some practical strategies to rebuild your business with limited finances:

1. Compute the Financial Damage

The initial phase in the business’s recovery process involves assessing the financial impact suffered. This necessitates a comprehensive analysis of various business segments, each requiring its own assessment.

Commencing with the financial aspect, it is essential to update all financial statements, such as the profit and loss or cash flow statement. By comparing these records to the previous year’s performance, we can determine the percentage of financial loss incurred.

Apart from direct financial losses, there are other areas that may have experienced significant damage. For instance, the reduction in workforce during the pandemic might have had a lasting impact. Additionally, excessive purchases of raw materials that are now unusable can contribute to the financial burden. Moreover, considering a marketing budget to attract consumers back is crucial in this assessment.

The business model that operated effectively before the pandemic may not be suitable for the post-COVID era.

2. Rethink Your Business Strategy

Your business plan might need to be adapted to align with the changing dynamics of the business landscape. For instance, if you relied primarily on a physical store, you’ll now need to establish a strong online presence.

Below are alternative ways to express the steps to reconsider your business plan:

- Assess the overall impact on the industrial sector.

- Compare and contrast with my own impacts.

- Analyze competitors’ operations and trends.

- Identify gaps in the competitors’ approach.

If you find it challenging to reassess your business plan, seeking assistance from the Small Business Administration (SBA) through mentoring services can help you revamp and improve your business strategy.

3. Necessity for Financial Aid in Business Recovery

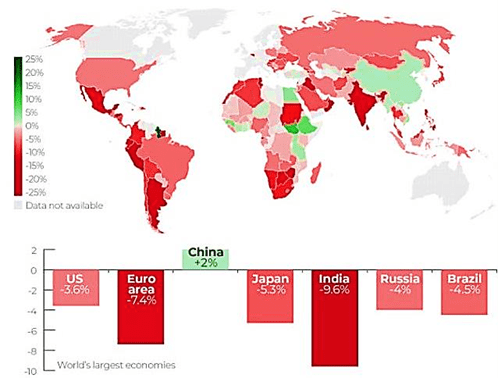

Regardless of the pre-pandemic financial condition, receiving assistance has become essential for the business’s reconstruction. This is a result of the widespread financial repercussions of COVID on the national economy. Nearly all countries worldwide experienced economic contraction, with the exception of China.

Firstly, you should contemplate the SBA loan service, which offers various loan choices, such as the Paycheck Protection Program.

As a second alternative for business recovery, you may want to consider Economic Injury Disaster Loans. These loans are designed for short-term usage to support employee retention.

In addition to the above, there are several other institutions that can provide assistance.

- Financial institutions offer small business loans to provide assistance.

- Traditional SBA 7(a) loans and microloans are available to support your business’s financial needs.

- Explore the option of business credit cards to help fund your enterprise.

- Consider obtaining a business line of credit as another viable resource for financing your operations.

4. Consider New Economy

Rebuilding a business post-COVID has become the primary focus of organizations, and this necessitates adapting to the new economy.

The pandemic has led to significant shifts in consumer behavior and purchasing patterns, resulting in the most dramatic economic changes in history. Industries like aviation, hotels, food services, and oil and gas have faced substantial setbacks.

Conversely, sectors such as grocery delivery, online education, on-demand entertainment, and logistics have experienced remarkable growth. This highlights the importance of reassessing the new normal and global economic trends.

Regardless of your business falling outside these heavily affected industries, it is still part of the interconnected global economy. Therefore, it is crucial to reevaluate and adjust your business practices to align with the new economy.

To successfully restart your business, your existing business plan may require innovative and digital transformations. It is essential to identify potential digital trends that can be implemented in your business and incorporate them into your strategy.

5. Create a fresh financial plan to restore and improve the business.

After COVID, businesses need to rebuild, which means spending money on recruiting and training new employees, as well as purchasing inventory to run the business.”

Most companies laid off workers during the pandemic, so now they have to hire and train new staff, which adds to the expenses. Buying inventory is also necessary to restart the business cycle.

During the recovery process, it’s crucial to be aware of all the business overheads and calculate the required amount to cover these expenses. The budget should aim to avoid wasteful spending and secure as much financing as possible.

The main goal is to minimize unnecessary spending during the rebuilding process and allocate enough funds for recruitment, training, and purchasing inventory to resume business operations smoothly.

6. Set the Milestone of Recovery

Focus on specific aspects of your business that need recovery, not the entire sector all at once.

Create a timeline with predicted milestones to guide your recovery process.

Prioritize your goals and work on the most critical task first.

Concentrate on one sector at a time, avoid multitasking.

Track your progress with each step and compare it to the set milestones.

Be mindful of your finances and save capital for your business.

Avoid spending on activities that do not yield sufficient benefits.

7. Pivot Business for Future

The pandemic highlighted the need to prepare for unpredictable events that may recur in the future.

Maintaining liquid cash reserves proved crucial for businesses during the pandemic.

Embracing innovative technologies and thinking creatively became essential during the crisis.

Businesses should learn from the experience and have contingency plans in place to handle emergencies effectively.

The importance of adaptability and flexibility in business operations became evident during the pandemic.

Businesses must prioritize research and planning to stay ahead of potential challenges.

Diversification and having multiple strategies for various scenarios became a recommended approach.

Conclusion

The rapid onset of the pandemic had a profound global impact, causing financial difficulties for businesses across the board. Numerous loan applications are being submitted to financial institutions daily. However, there remains optimism for business recovery. I have outlined a few approaches to rejuvenate a business with limited finances.

I trust that these strategies have sufficiently addressed your query on rebuilding your company post-pandemic.

If you have any doubt regarding this, then you can send your doubts on companysuggestion and our team of experts will guide you.